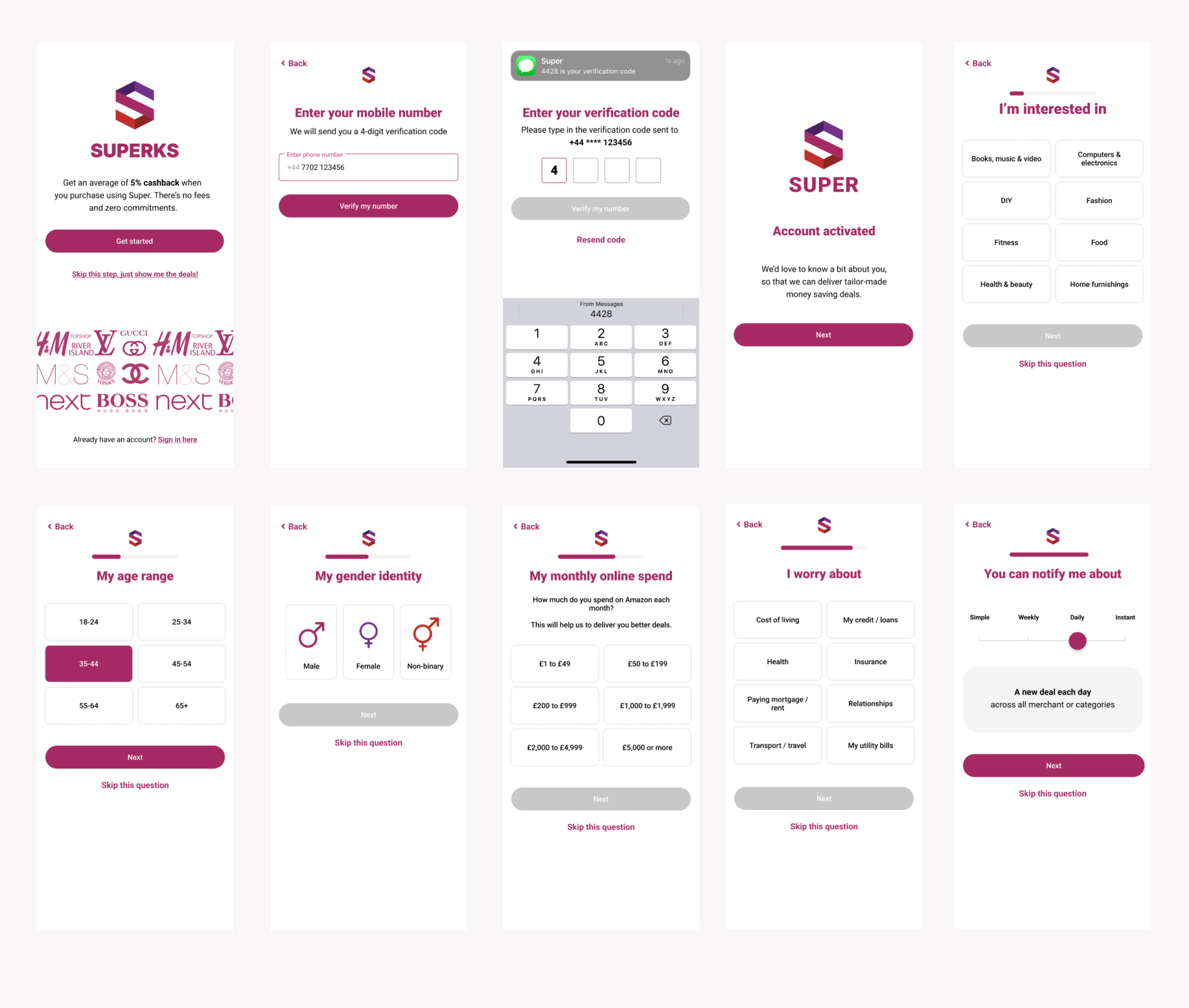

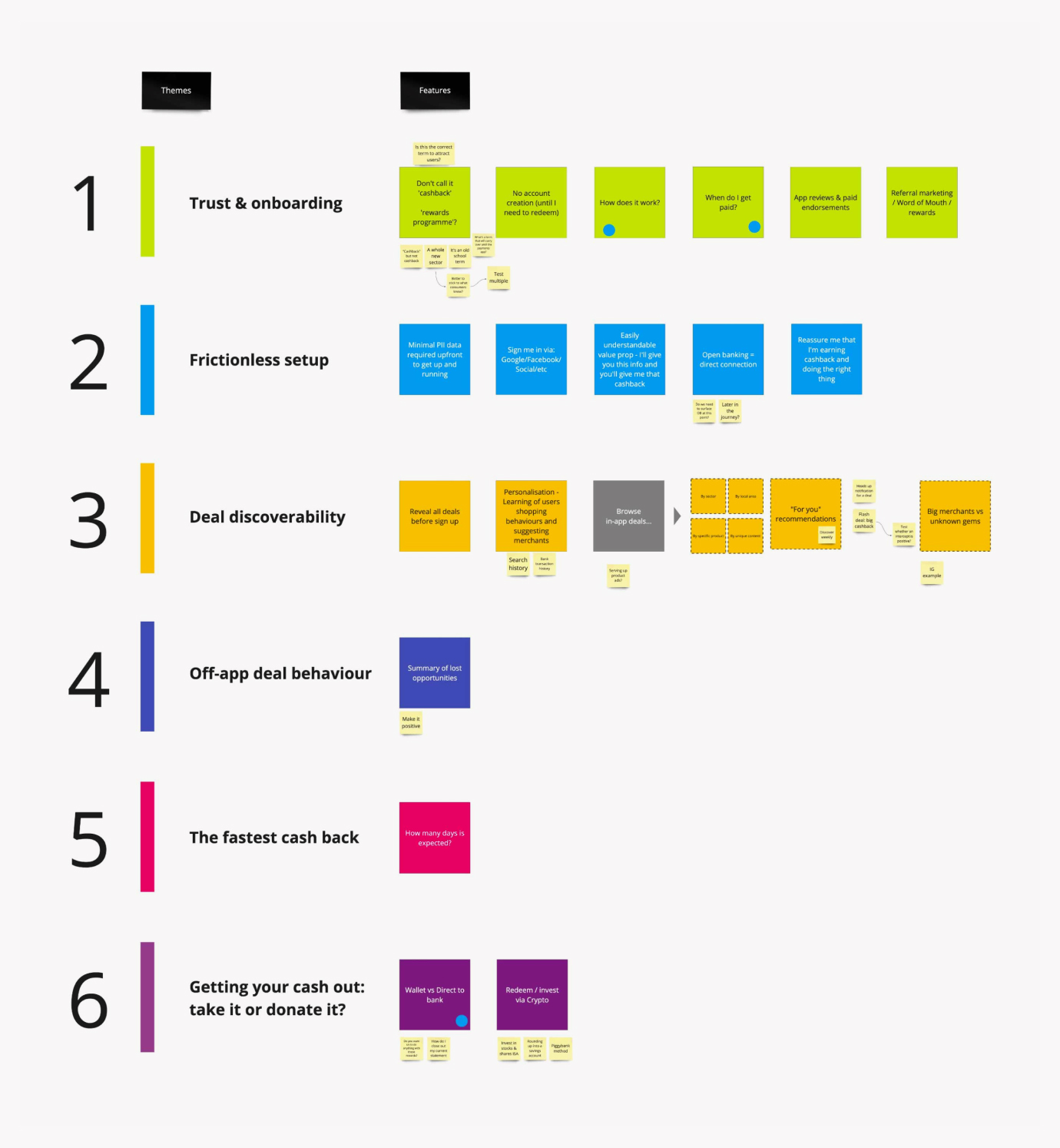

Onboarding / sign up

For the initial concept test we wanted to see how far users would be willing to go in handing over personal details for a product they hadn’t used before. We included things like categories of interesting within the app, age range, gender and even monthly household income.

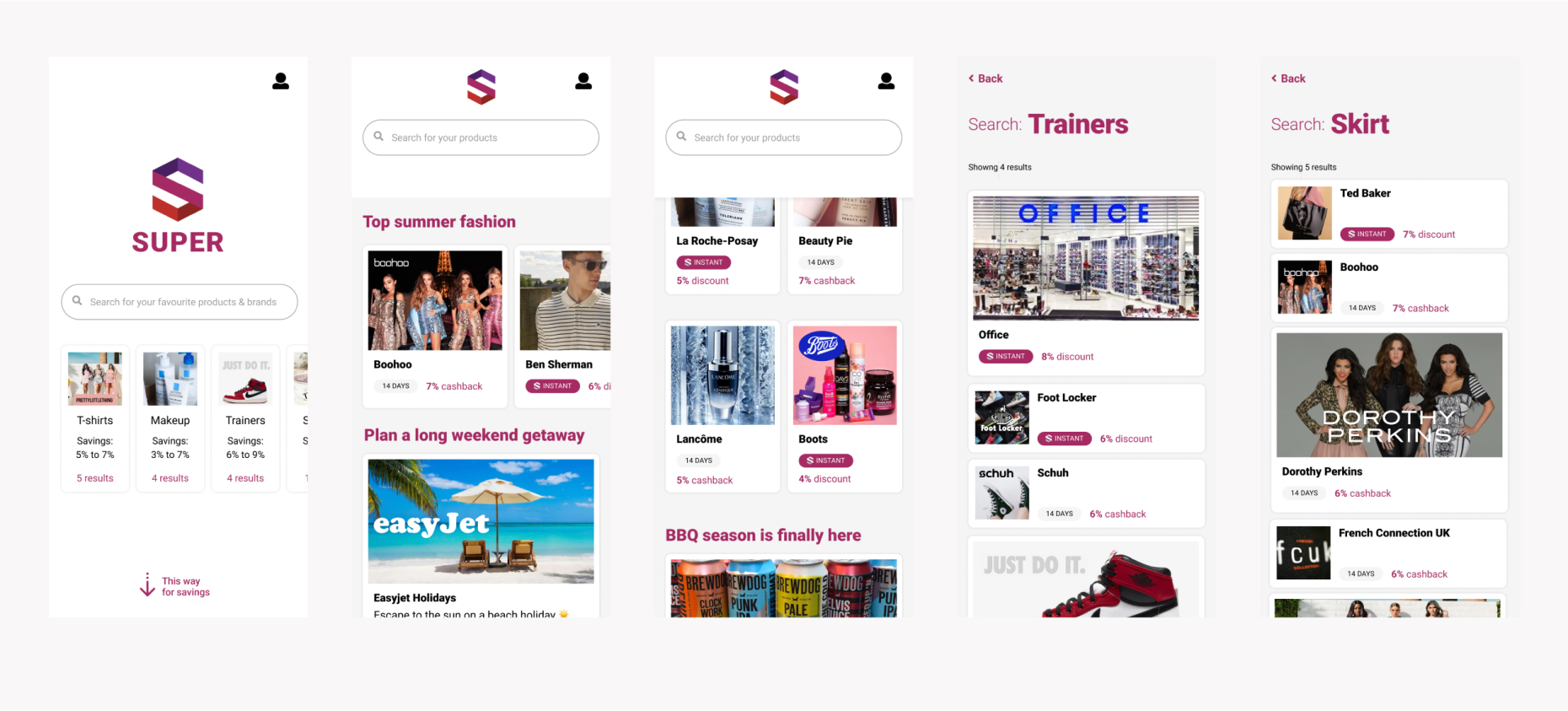

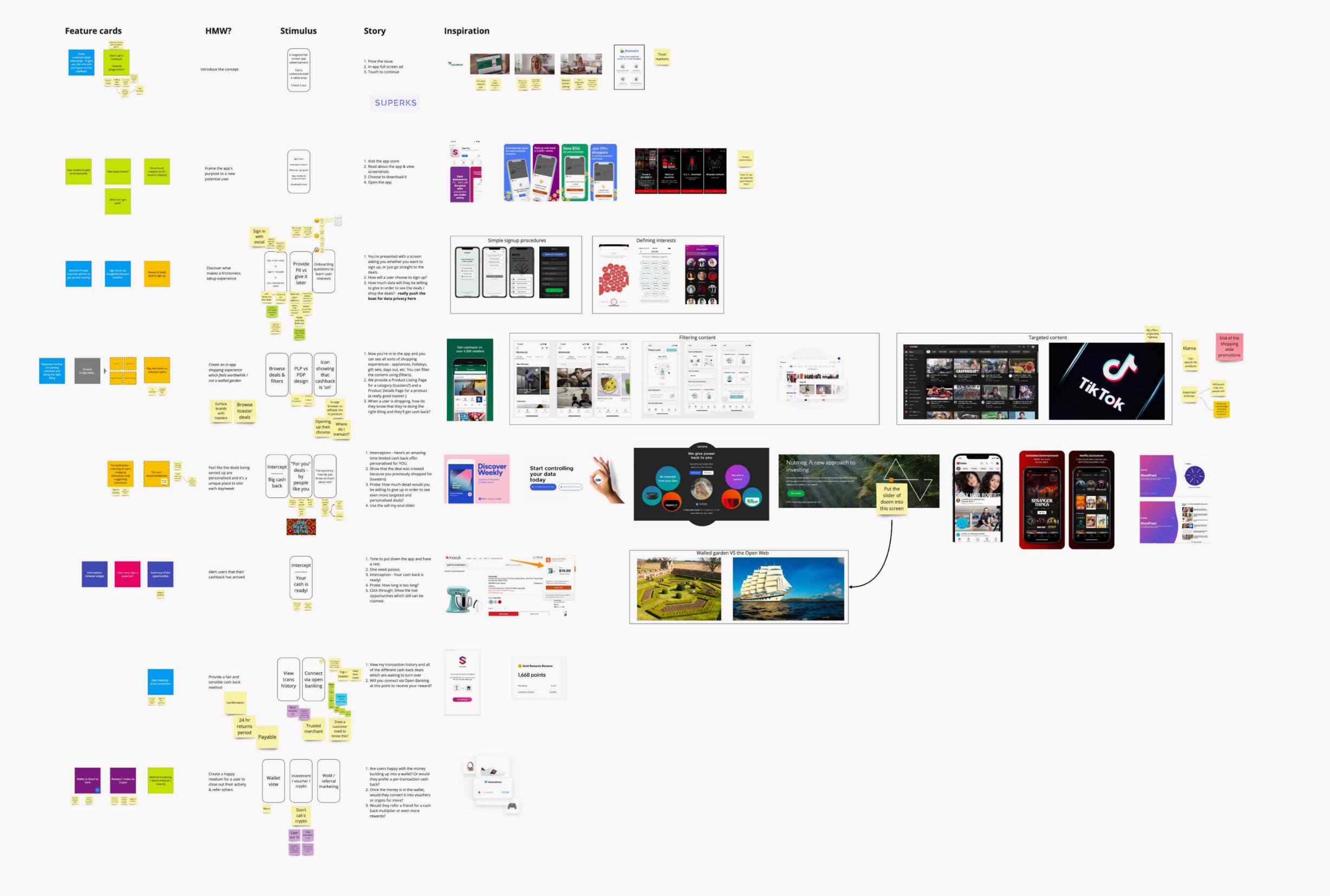

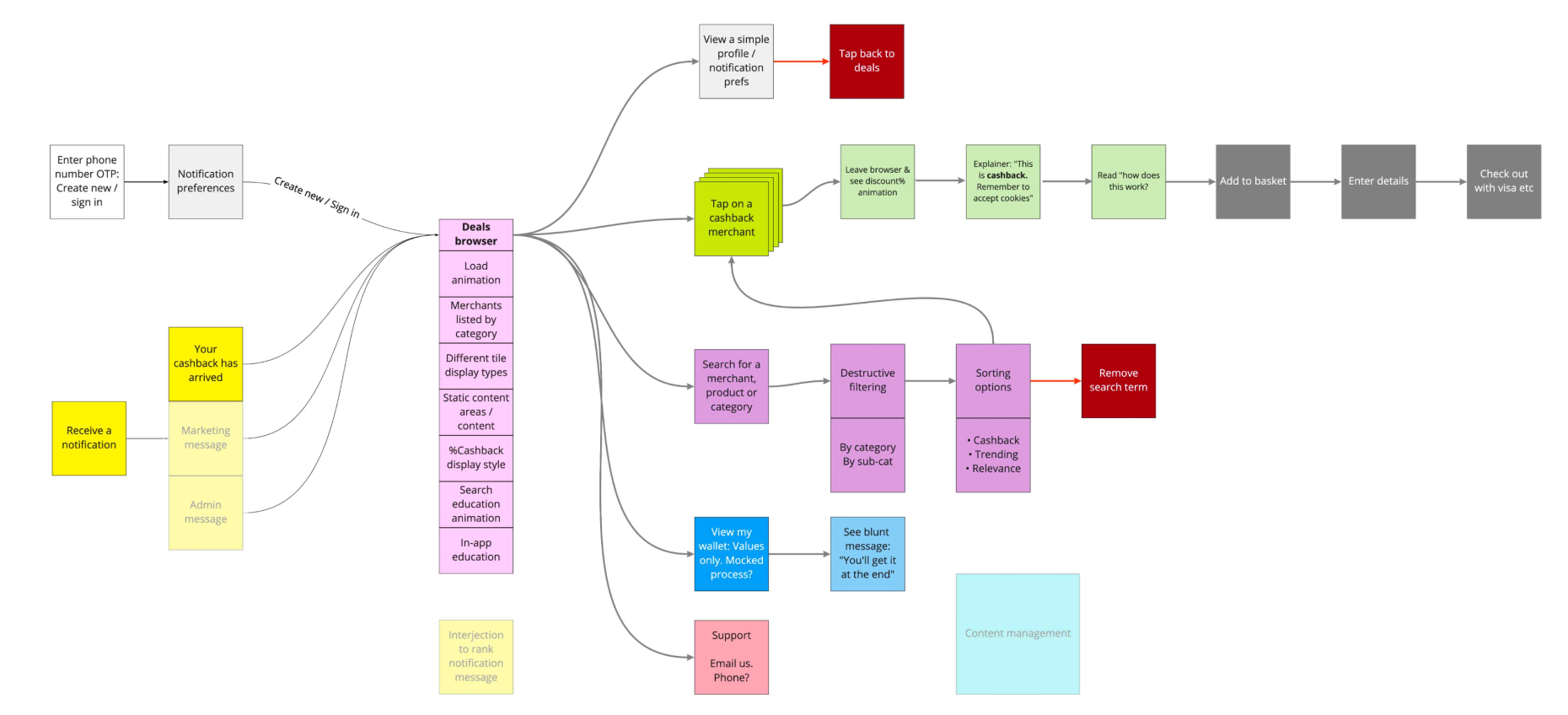

Browsing the deals

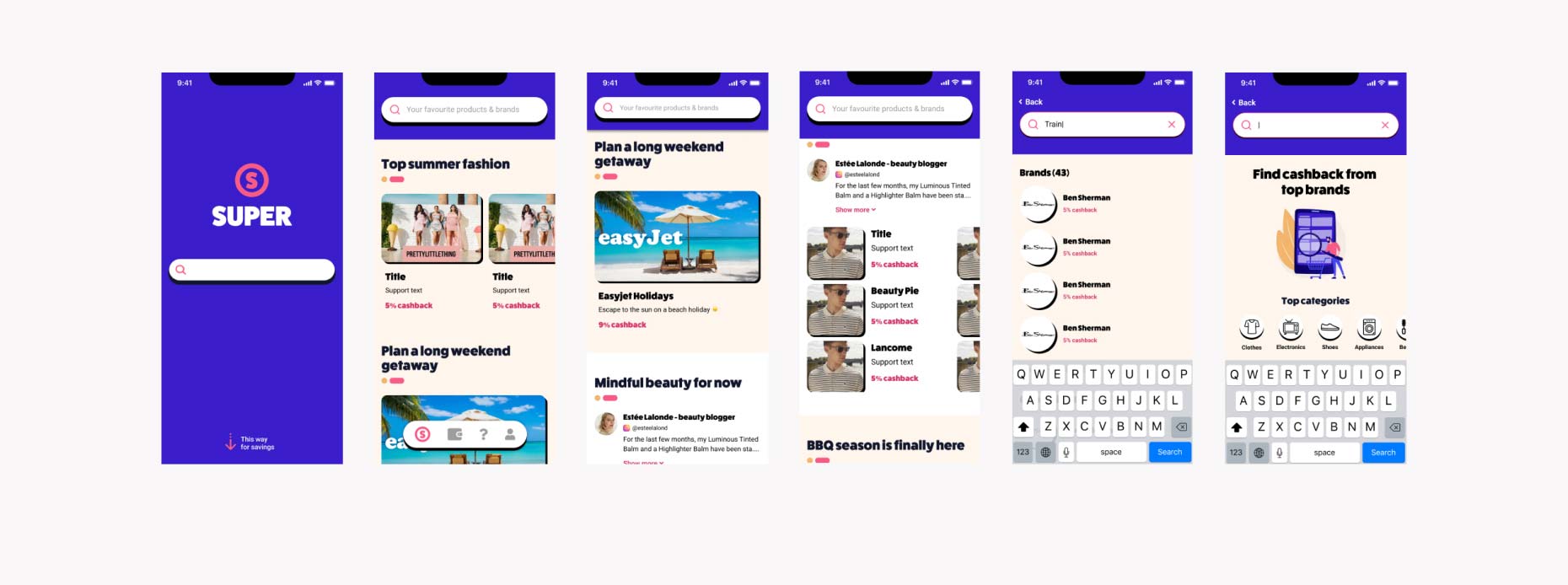

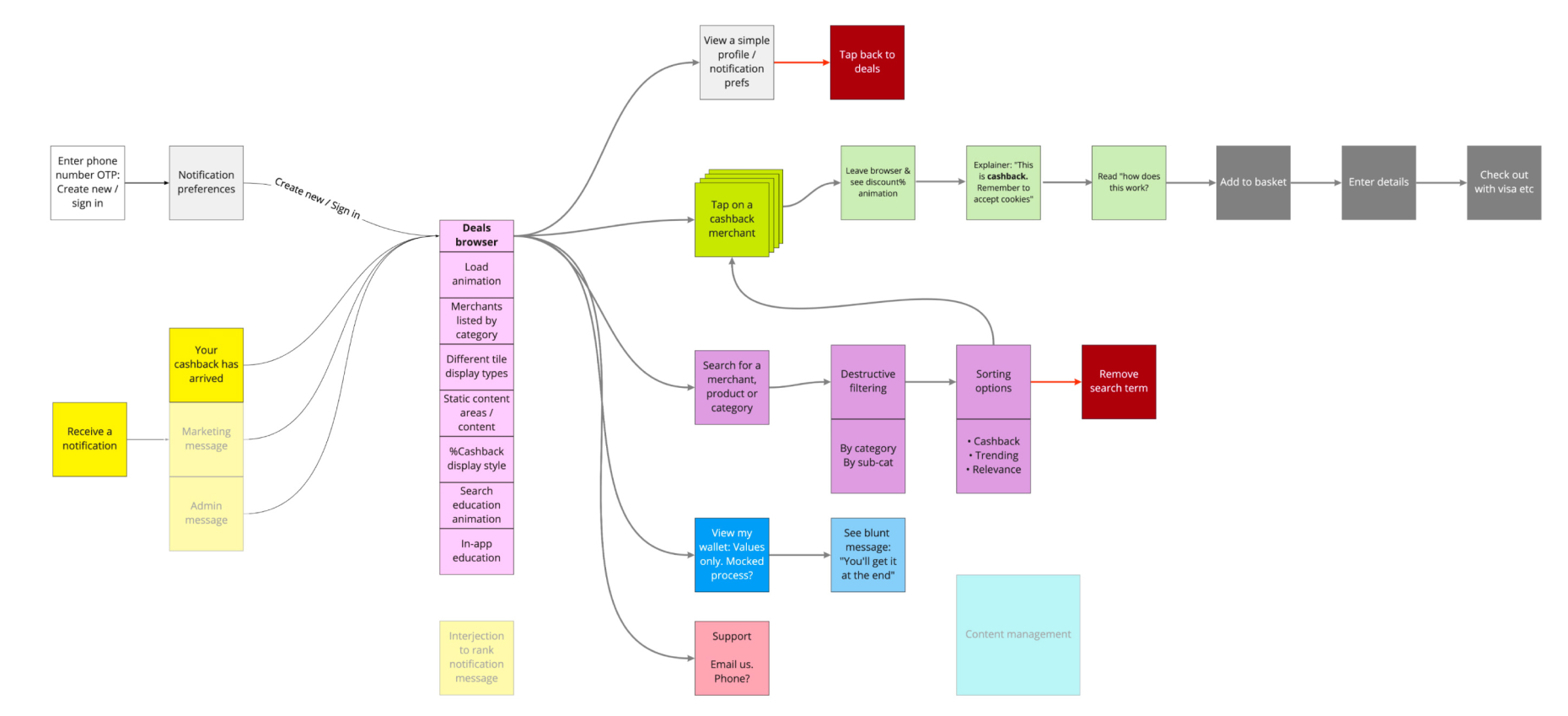

The bulk of the app consists of the cashback deals, the wireframes were created to show how this may look and what sort of categories and merchant types could be included. There was also the ability to search by product, category or merchant.

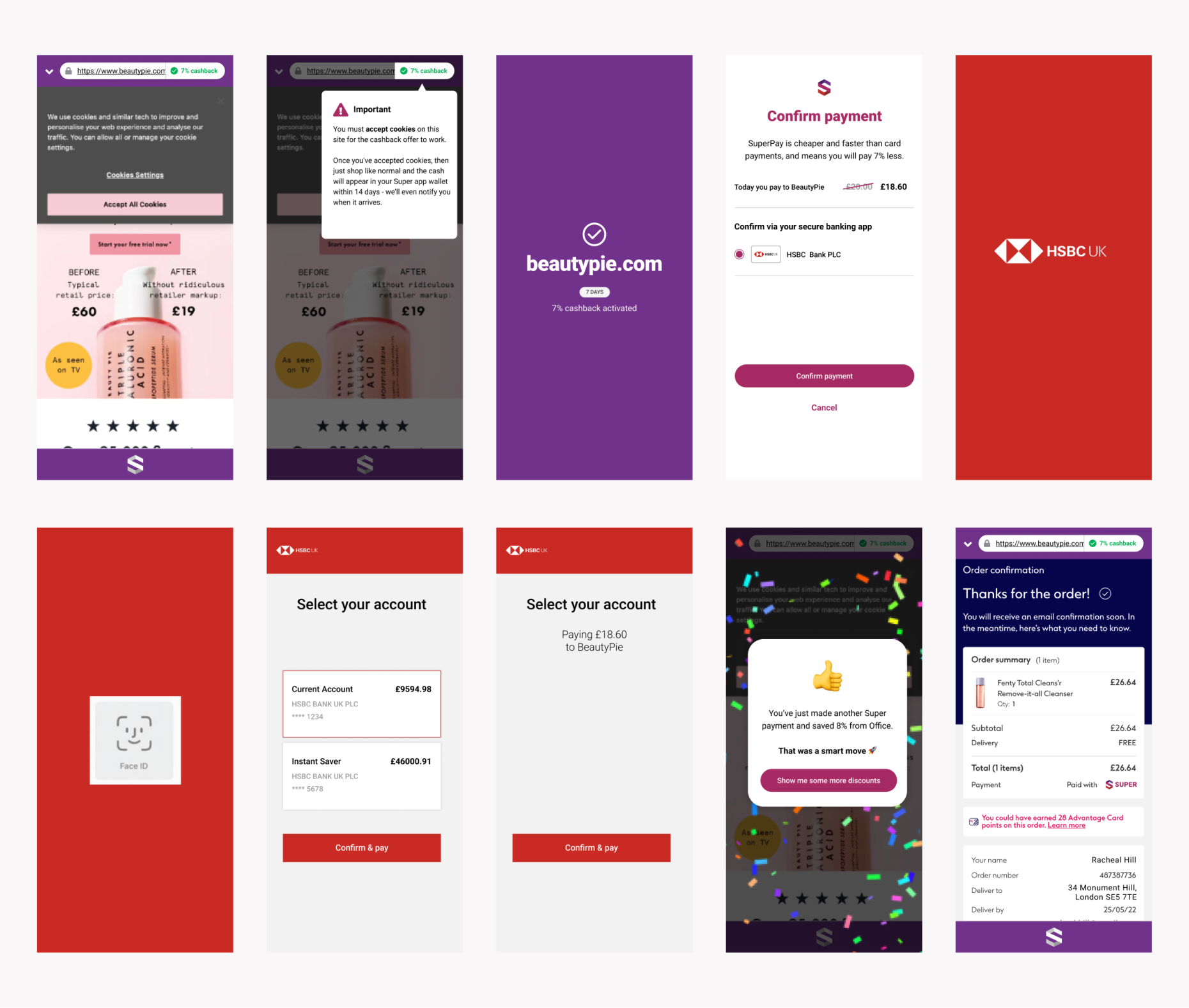

Checking out with Open Banking within the app

A flow was included to allow the user to pick a merchant, find a product and then checkout thorough the app. It shows how the user must accept cookies on the merchants site in order to claim their cashback and then paying using open banking.

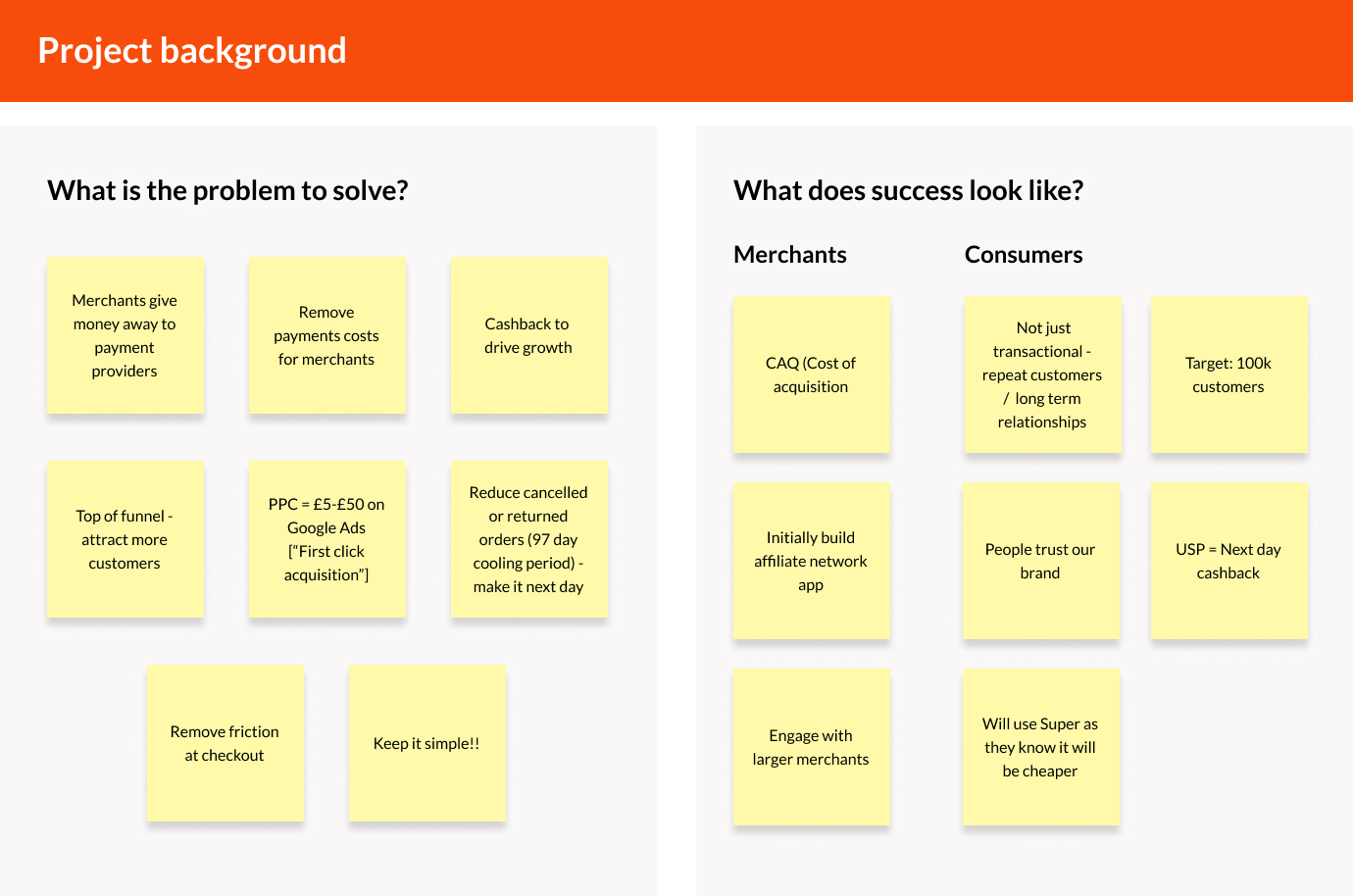

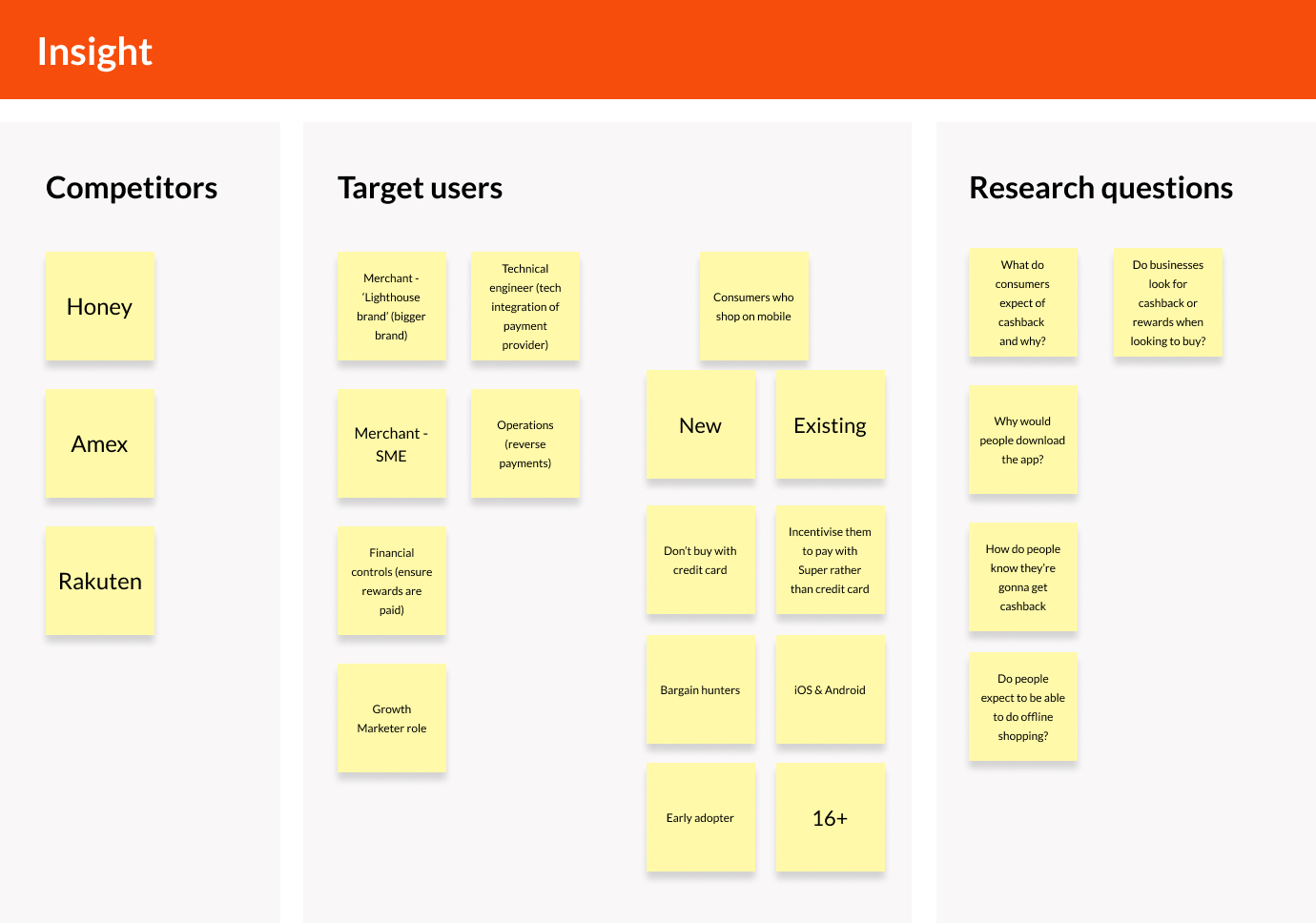

The concept test was conducted by a UX researcher at the UX Agency. He created the discussion guide for the sessions, ran the sessions and fed back his findings, including recommendations for the next interaction of the design. The goal of the concept test was to get a good understanding of the following:

How appealing is the proposition

Would a user be willing to use the Superks cashback app to pay for an item online to receive cashback

How much personal information is a user willing to give when signing up for the app

Do users understand the the process they must follow in order to receive the cashback

Are users comfortable using open banking as a way to complete a payment

Are the deals available appealing

The concept test was conducted by a UX researcher at the UX Agency. He created the discussion guide for the sessions, ran the sessions and fed back his findings, including recommendations for the next interaction of the design.

INSIGHTS FROM TESTING

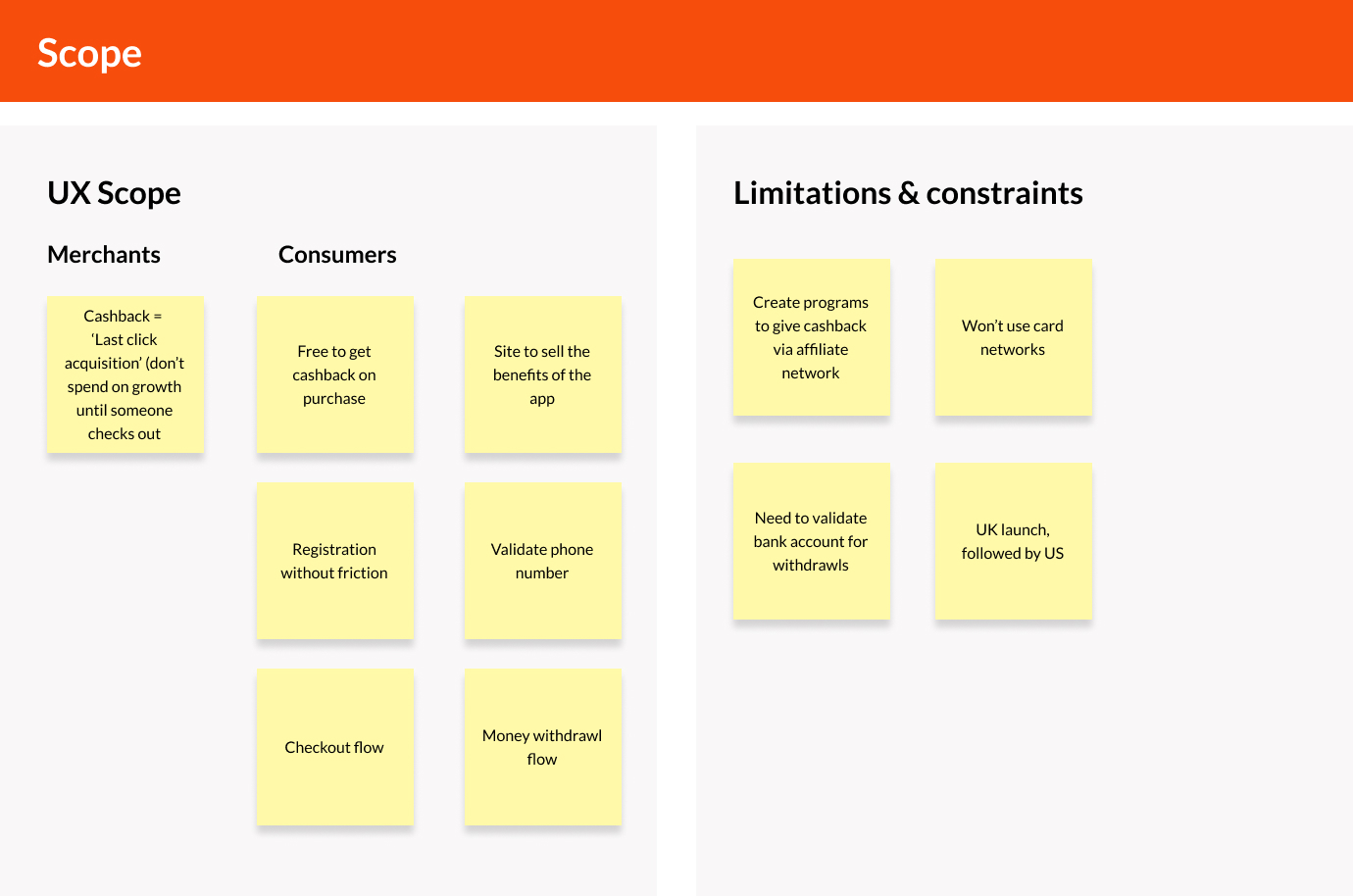

Some of the key iterations included from the concept testing insights were:

Onboarding data capture

Reducing the data requested at onboarding to just adding your phone number for speedy non-intrusive onboarding.

Education screens

The onboarding flow now included a set of “Education screens” to help users understand the cashback percentages available and when you are likely to get the cash, and how they know they have received the cashback.

Search

Being able to search by brand, and also by category and product type is a massive bonus that is not found in the competition.

Instant cashback

The original USP of the product was that instant cashback would be offered, rather than the user having to wait the standard 30-90 day period, found in other products. The research showed that this USP was not something that resinated with any of the users and dues to the high business risk involved in fulfilling the USP, should be removed from the product.

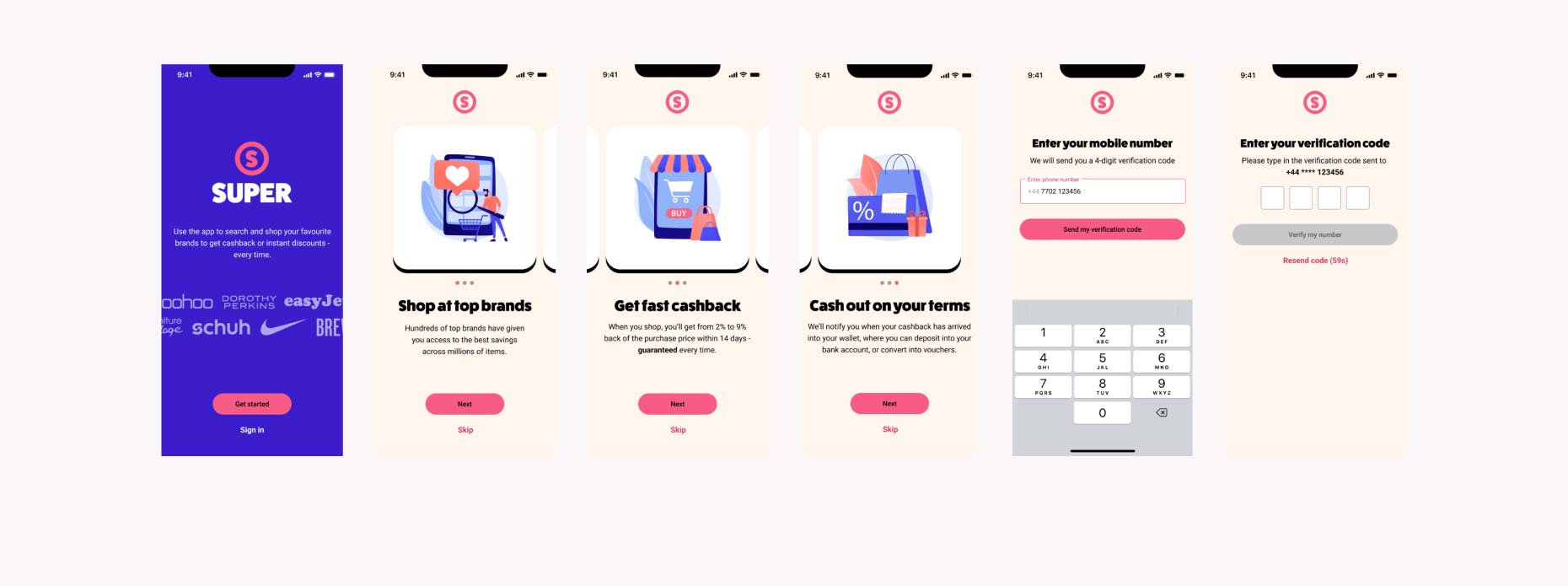

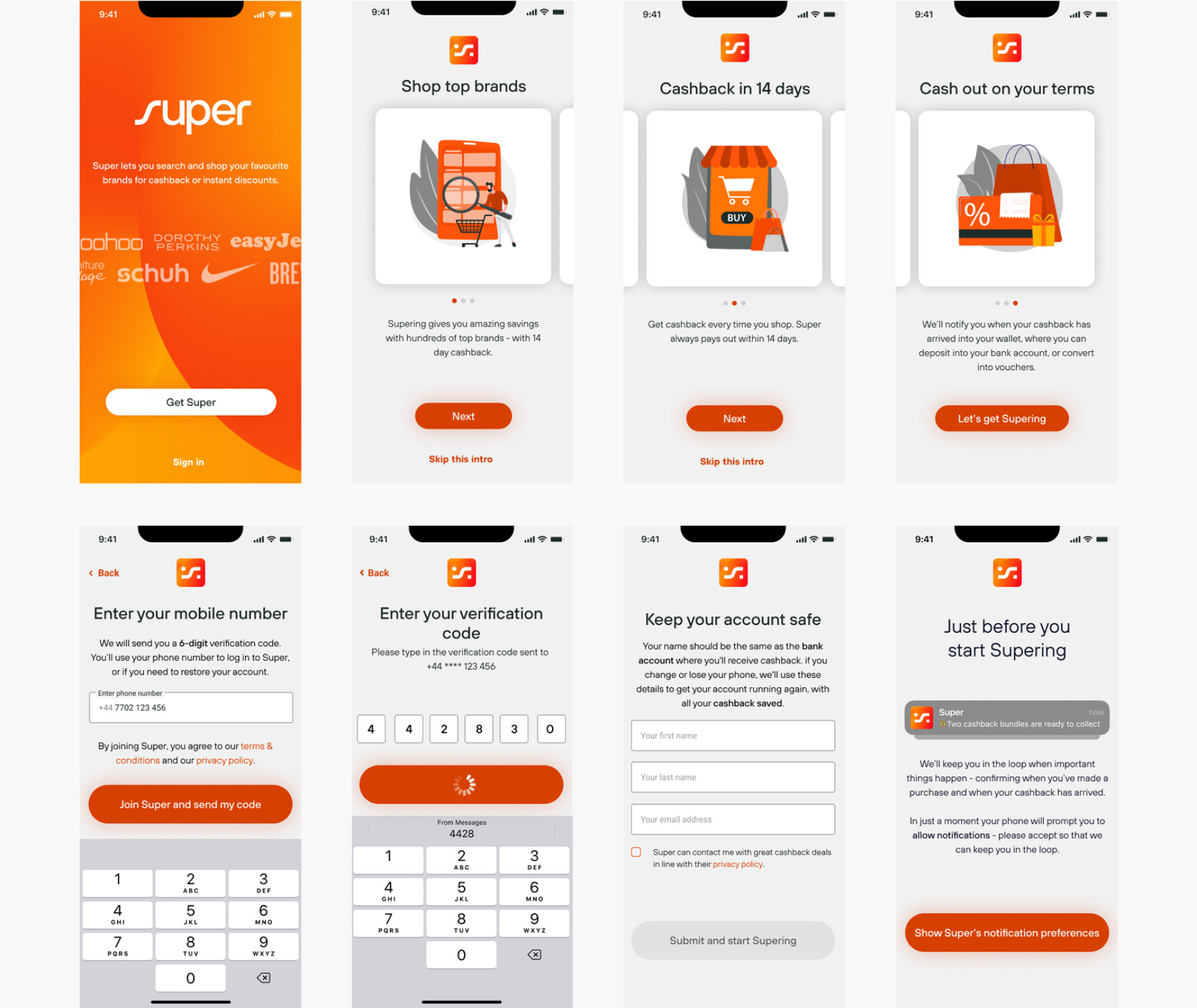

Onboarding / sign up

A much shortened onboarding flow was created, including 3 educational screens to explain the app and it’s key features and then just the requirement of adding your phone number, with a validation code step to confirm the number.

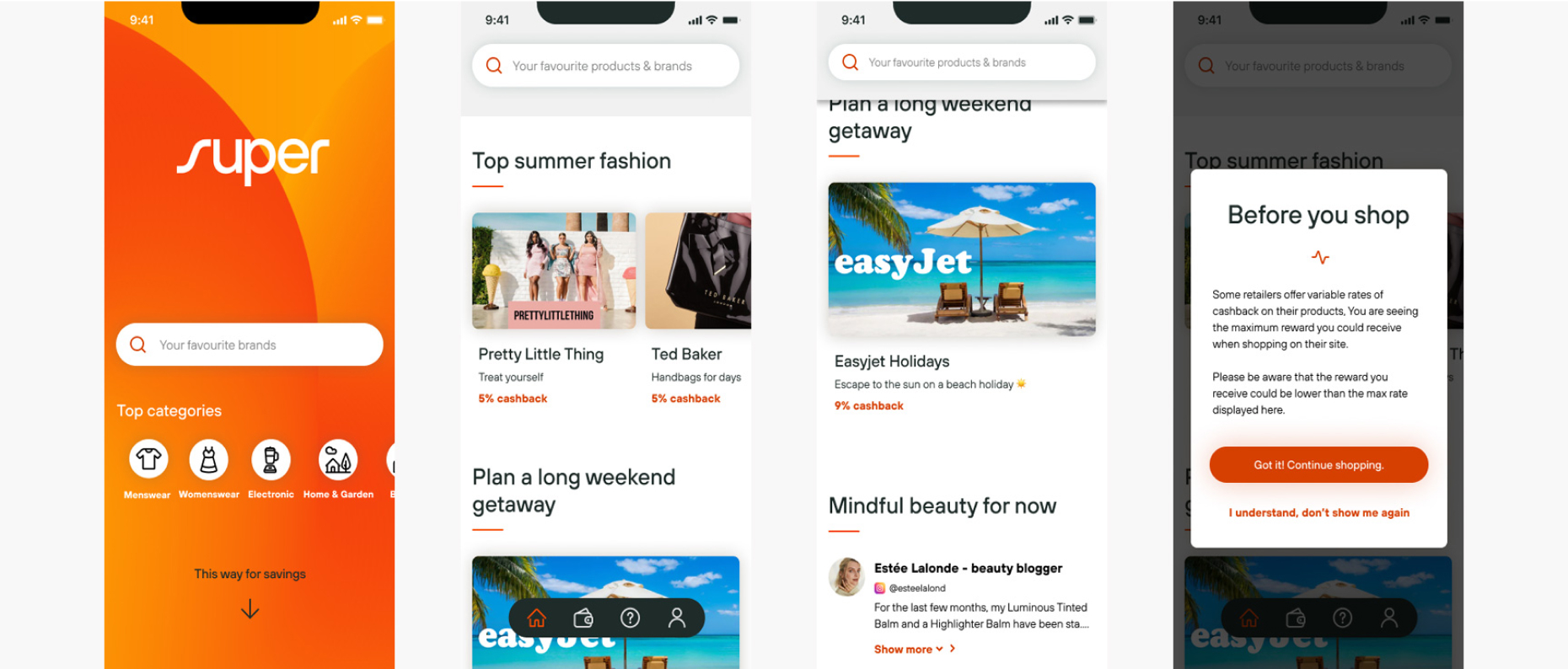

Browsing the deals

The deal browsing section was largely kept the same as it tested very well, it was refreshed with the progressed UI and a content section was added from social media influencers recommending their top deals in the app.

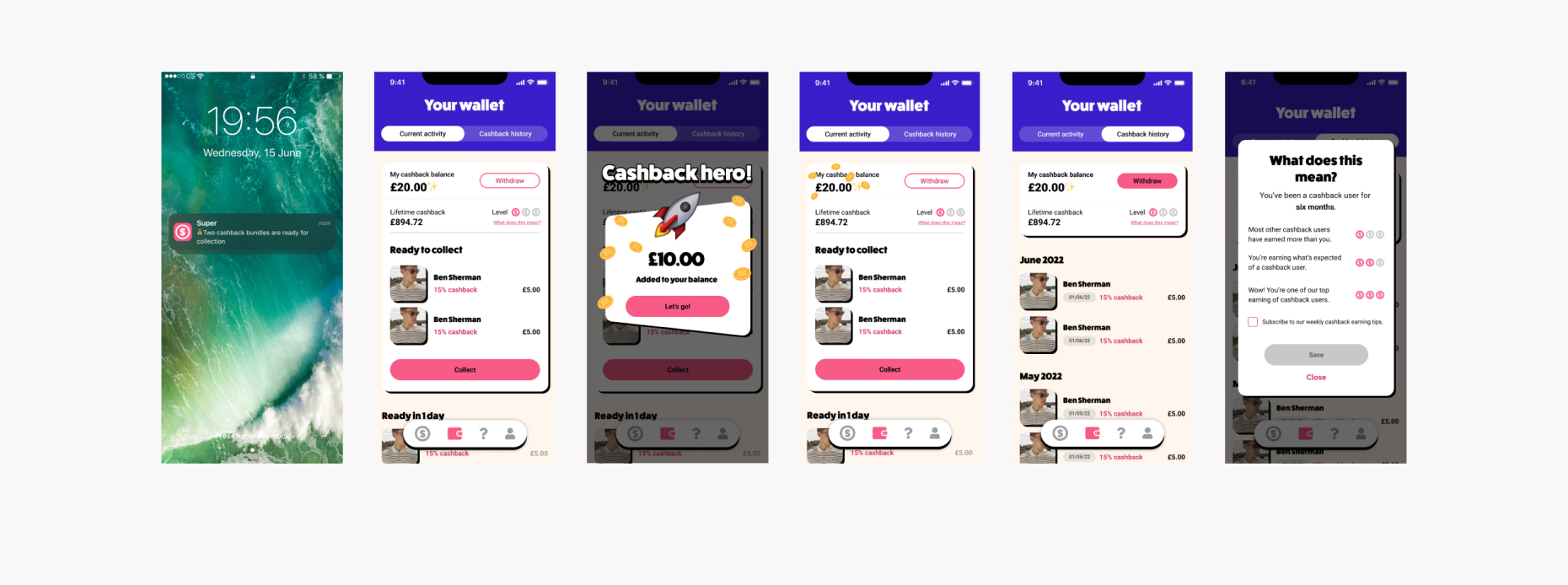

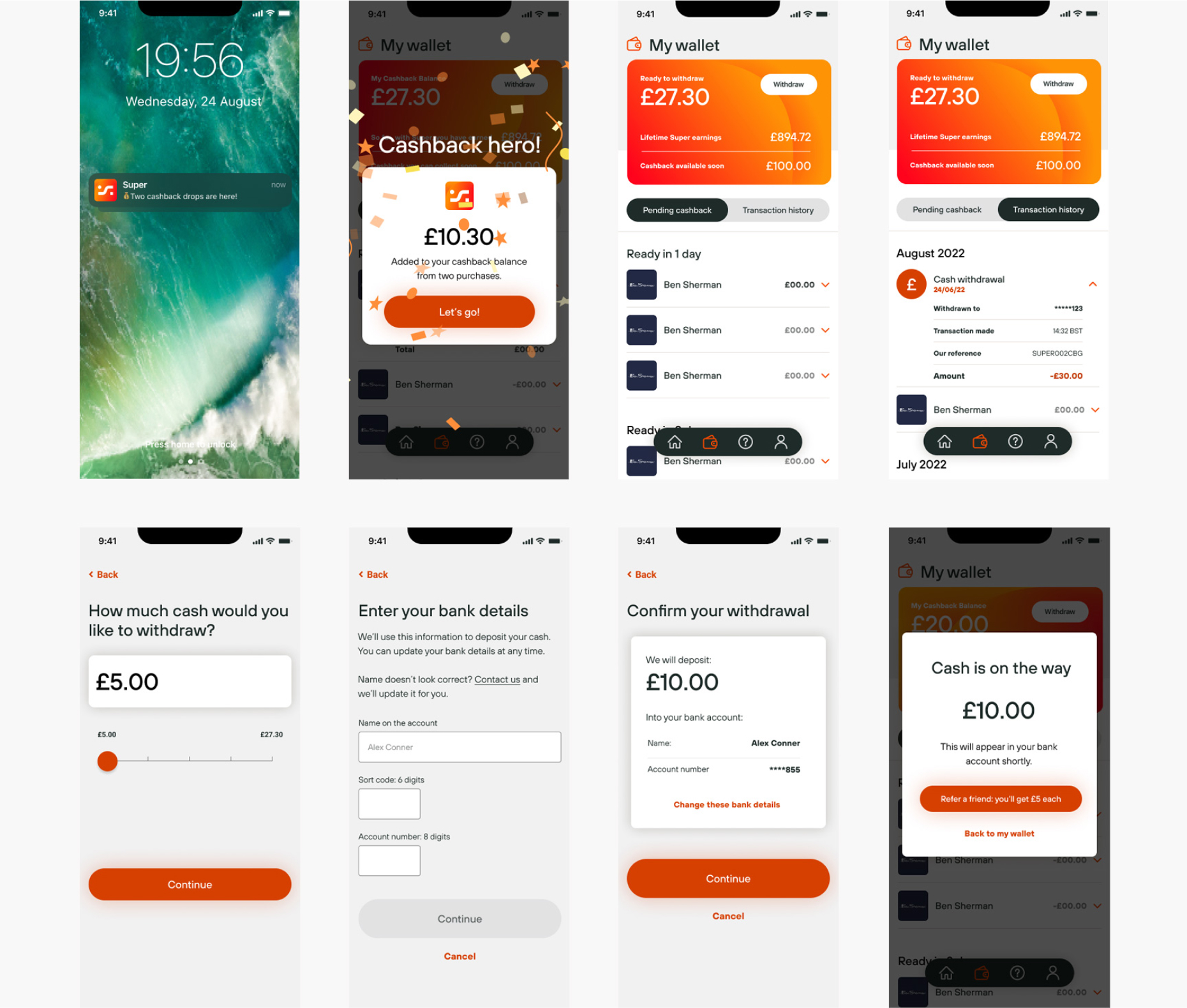

Claiming your cashback / wallet

A new section was added to the pilot that allowed the user to claim their cashback though a wallet section within the app. It showed all their current activities and cashback history. Adding this section complete the end to end journey a user would take from downloading the app to claiming their cashback.

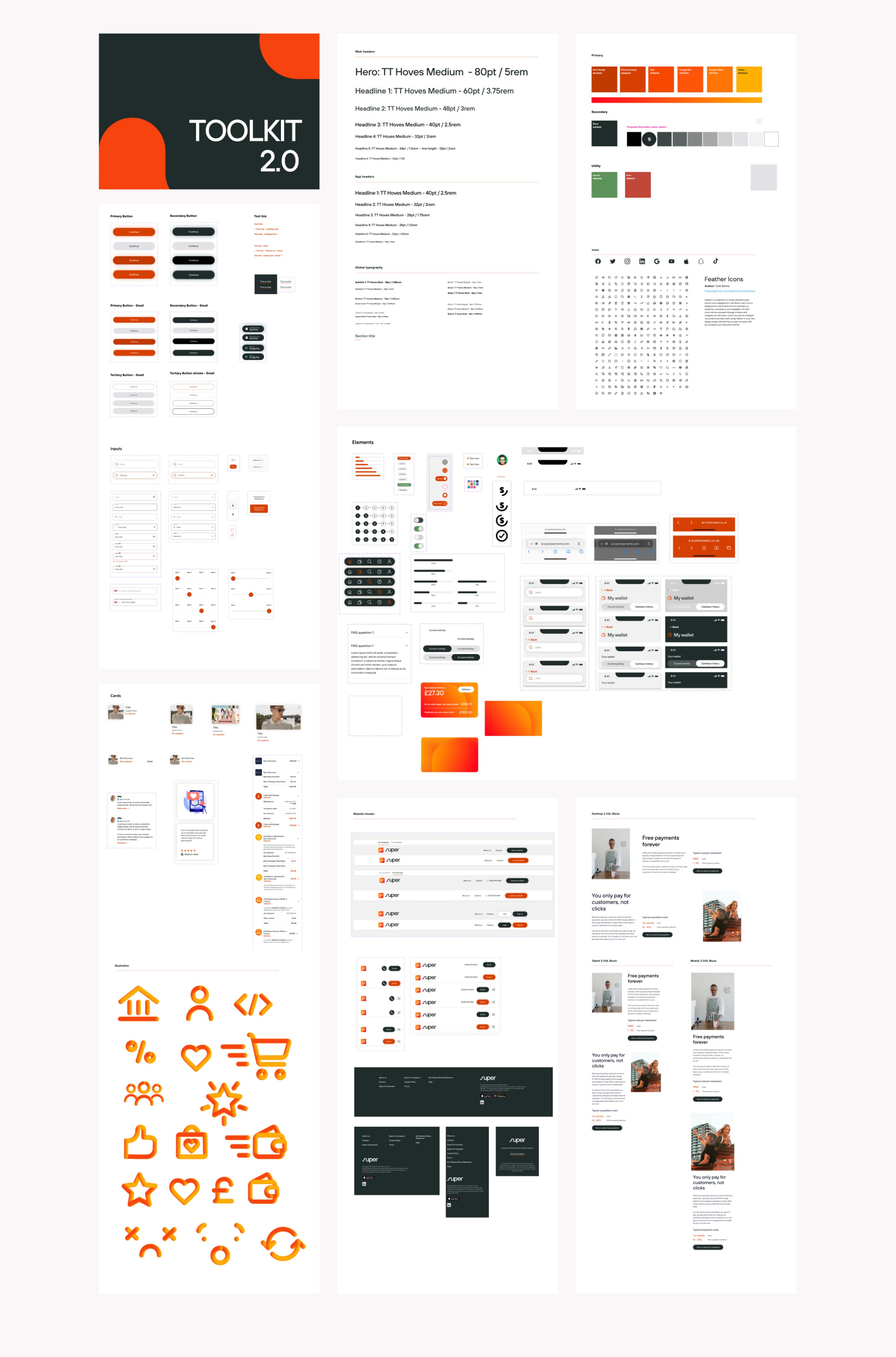

Design system

A new brand was created by a branding agency and this was now to be applied as part of the final UI development. I developed all the components used into a design system for speed and consistency of the next round and for future designs. It reached a v2.0 stage before being implemented into the UI designs.

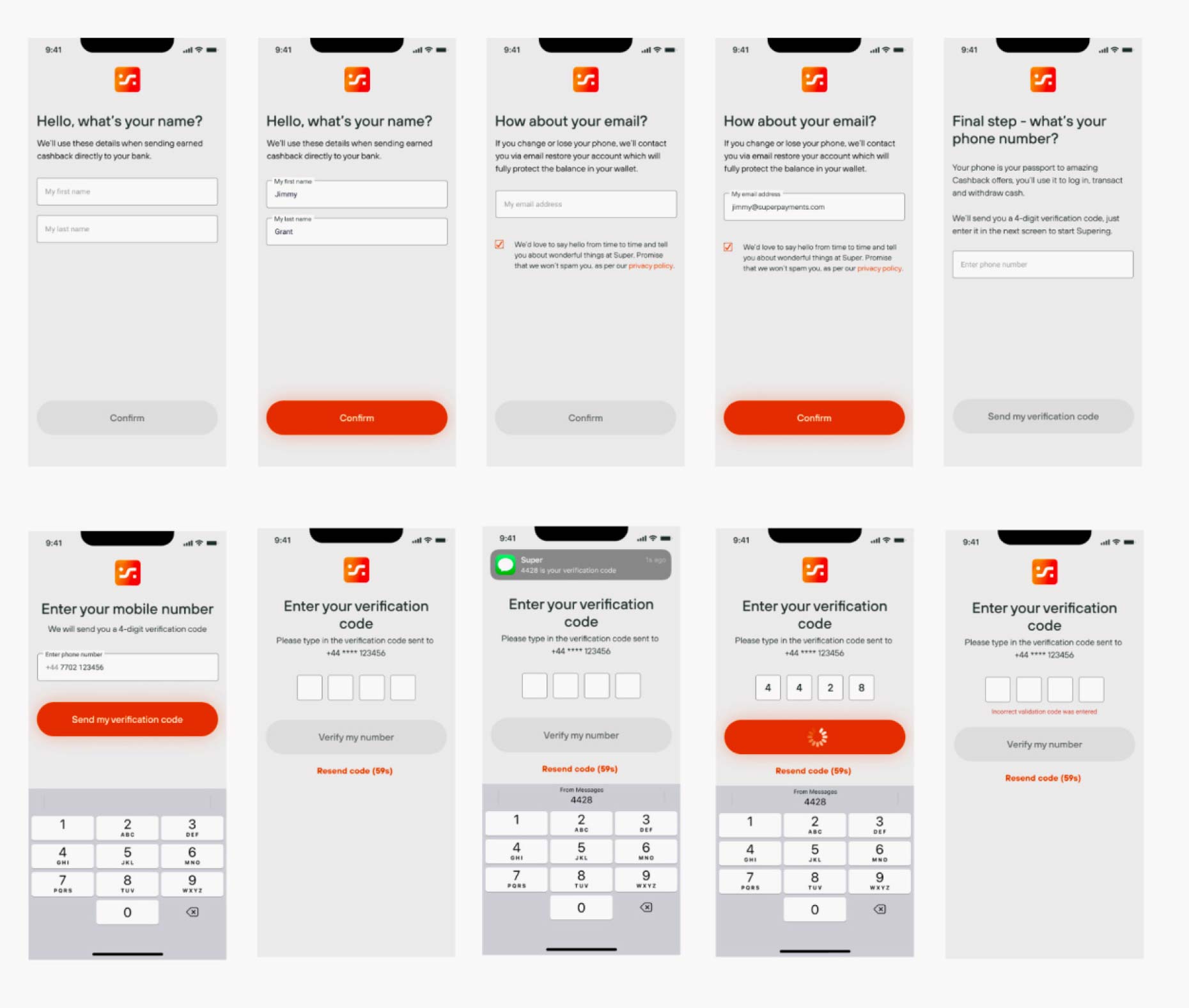

Onboarding / sign up

The new UI treatment was applied across all screens, and the granular detail of content added, including privacy policy and terms and conditions.

A further business requirement, based on security reasons of onboarding a user, was to add name and email. This is not the ideal path from user feedback, but a compromise was made to keep the users account secure with their money and financial details.

Browsing the deals

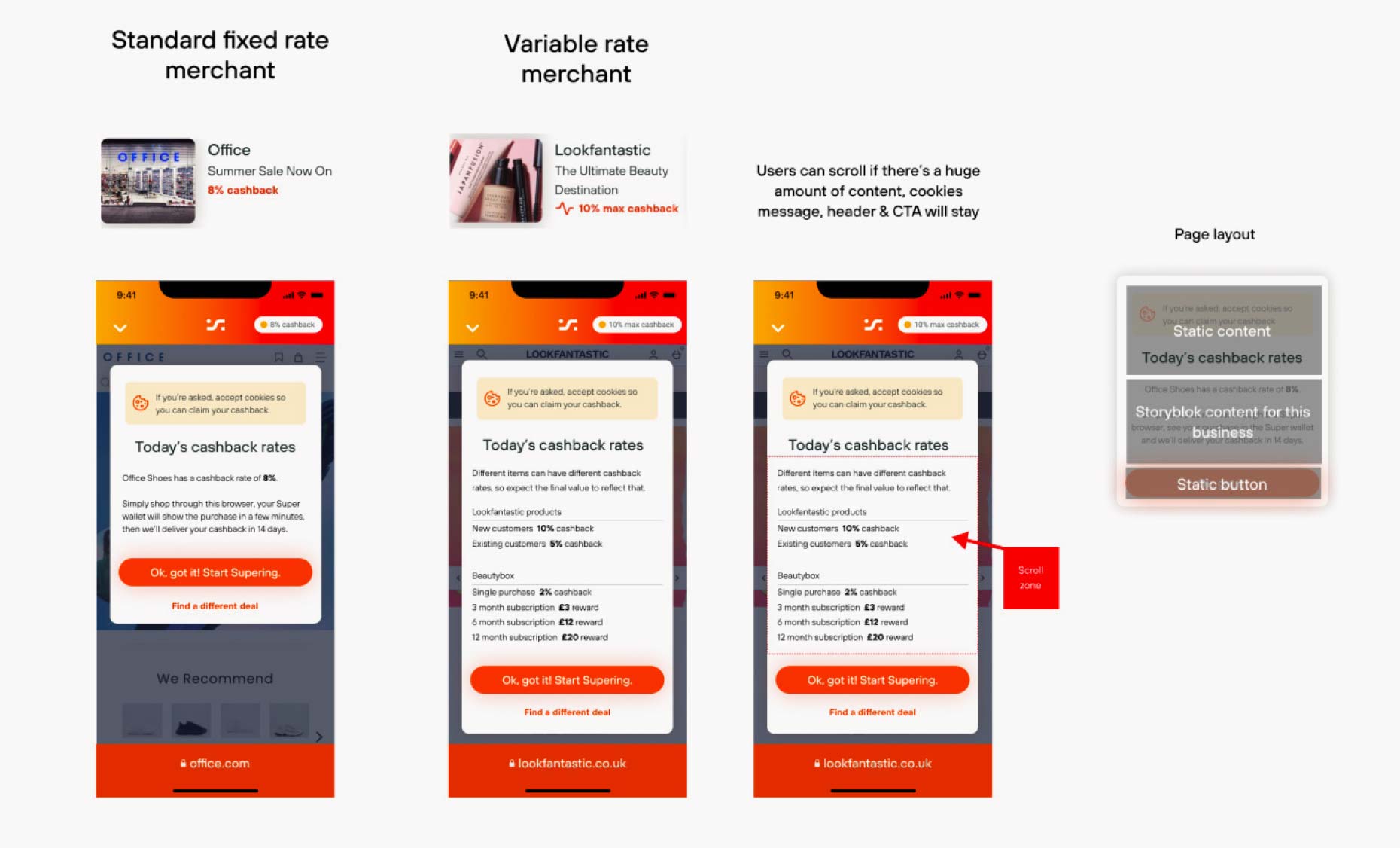

A step was added in the deals browsing flow that gave a take over modal explaining to the user that they had to accept the merchant website cookies to claim their cashback. This approach was taken as user testing session highlighted it was not clear to a user.

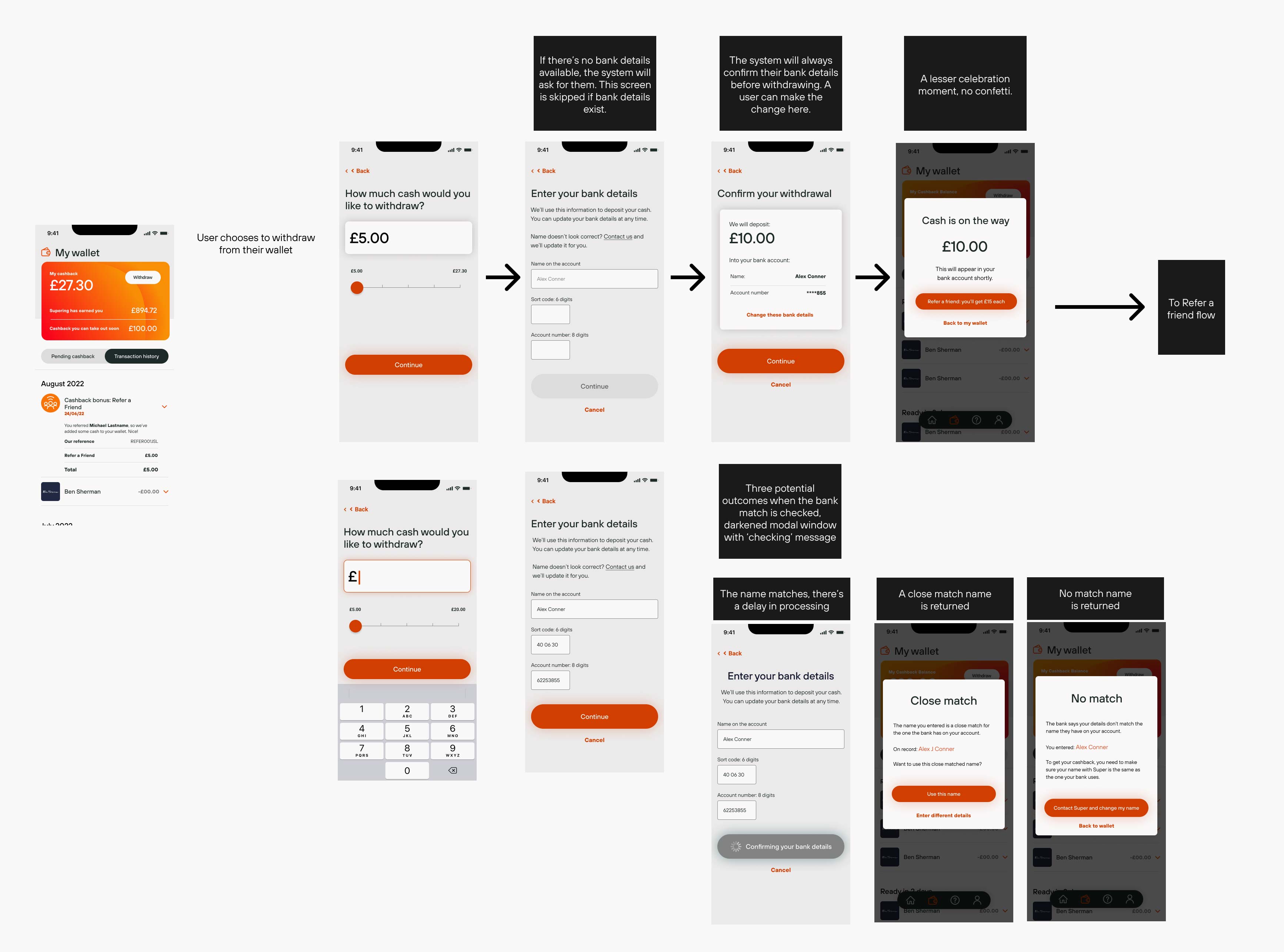

Claiming your cashback / wallet

Payment processing flow

Phase 2 onboarding - conversational sign-up

Making users aware of variable cashback rates

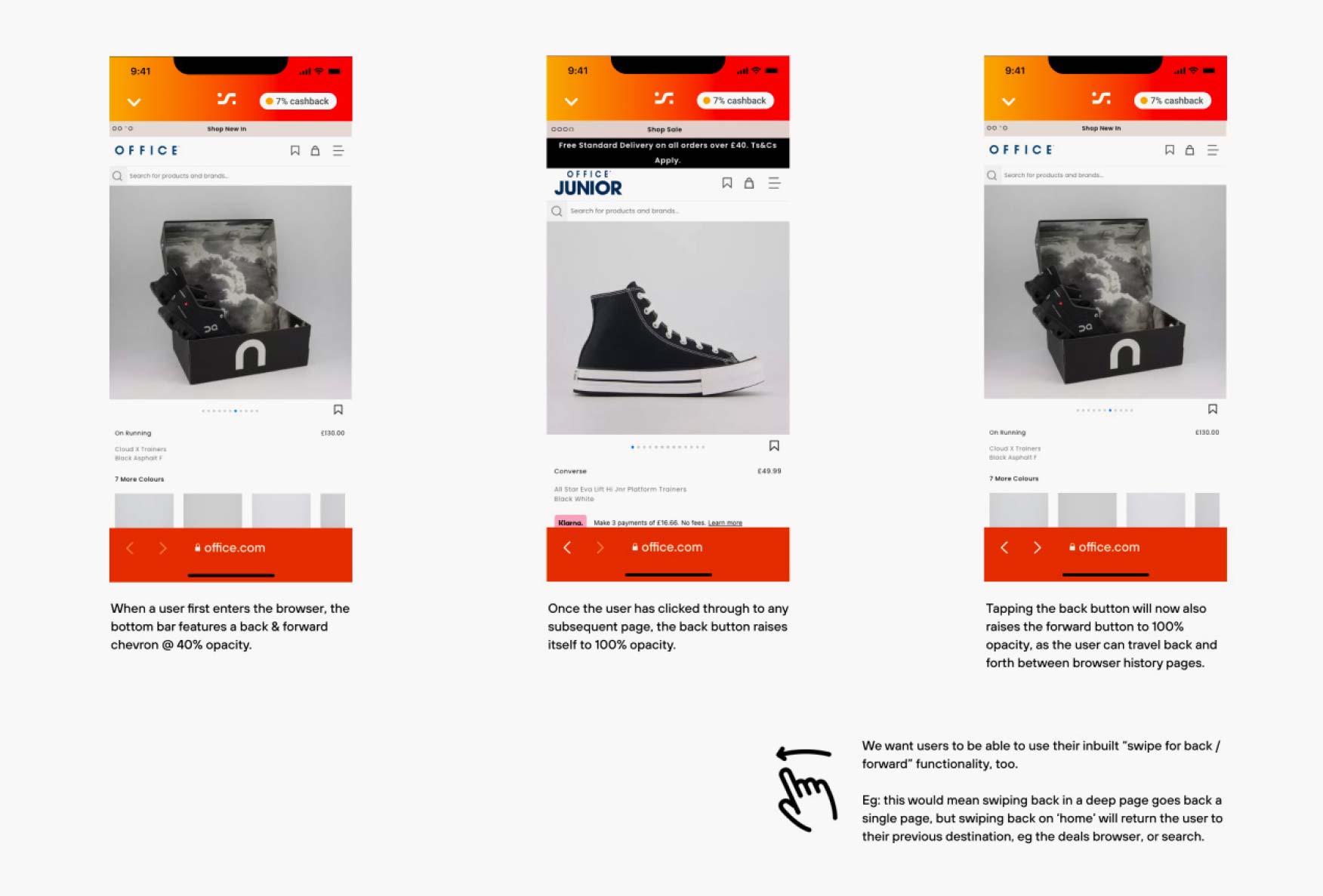

Using the Super browsers “back” button.

SUMMARY

Using rapid iteration to design multiple phases of the cashback app allowed us to feed the development team and launch the MVP product within 4 months - a super fast turnaround from the initial research.

One of the real successes of the process used to create the product, was using research to prove the validity of the initial business hypothesis. The business initially put themselves at a high financial fulfillment risk of giving a user instant cashback and it was shown in the testing that a user would rather have higher cashback percentages than instant cashback.